What Costs Are Involved in Selling a Home in Salt Lake County? Mark Haaga’s Expert Breakdown

What costs should you expect when selling your home in Salt Lake County?

From agent commissions to title fees and taxes, there’s more to selling your home than just collecting a check. Here’s a transparent breakdown of typical seller-side expenses you should plan for—and how the Mark Haaga Real Estate Team helps you keep more of your equity.

1. Real Estate Agent Commission

🔗 Read the official NAR settlement announcement

Typical Range: 5%–6% of the sale price (usually split between buyer's and seller's agents)

This is often the biggest line item in your closing costs. It’s negotiable, but most sellers in Salt Lake County agree to a commission in this range. The cost is split between the listing agent and the buyer’s agent.

💡 With the recent NAR settlement changes, some buyer agent compensation may be handled differently moving forward. We’ll help you navigate what’s fair and compliant.

2. Title Company Fees, Escrow Charges & Utah State Transfer Fees

Typical Combined Cost: $1,200–$2,500+ depending on sale price, services included, and title company

These costs include the escrow closing fee, title search, and issuance of the owner’s title insurance policy. The escrow company acts as a neutral third party to handle documentation, disbursement of funds, and legal title transfer.

In Salt Lake County, sellers typically cover:

The escrow fee (can range from $475–$1,200+)

The owner’s title insurance policy (often $700–$1,200+ depending on home value)

Courier or document prep fees (if applicable)

You’ll also pay a recording fee to the Salt Lake County Recorder’s Office, which usually ranges from $40–$80. This officially records the deed in the buyer’s name.

🔍 Want to see sample fees? Visit Fidelity National Title Agency – Utah Division.

💡 These numbers can vary significantly based on your sale price and which title company is selected. We review multiple estimates with our clients to avoid surprises and reduce unnecessary costs.

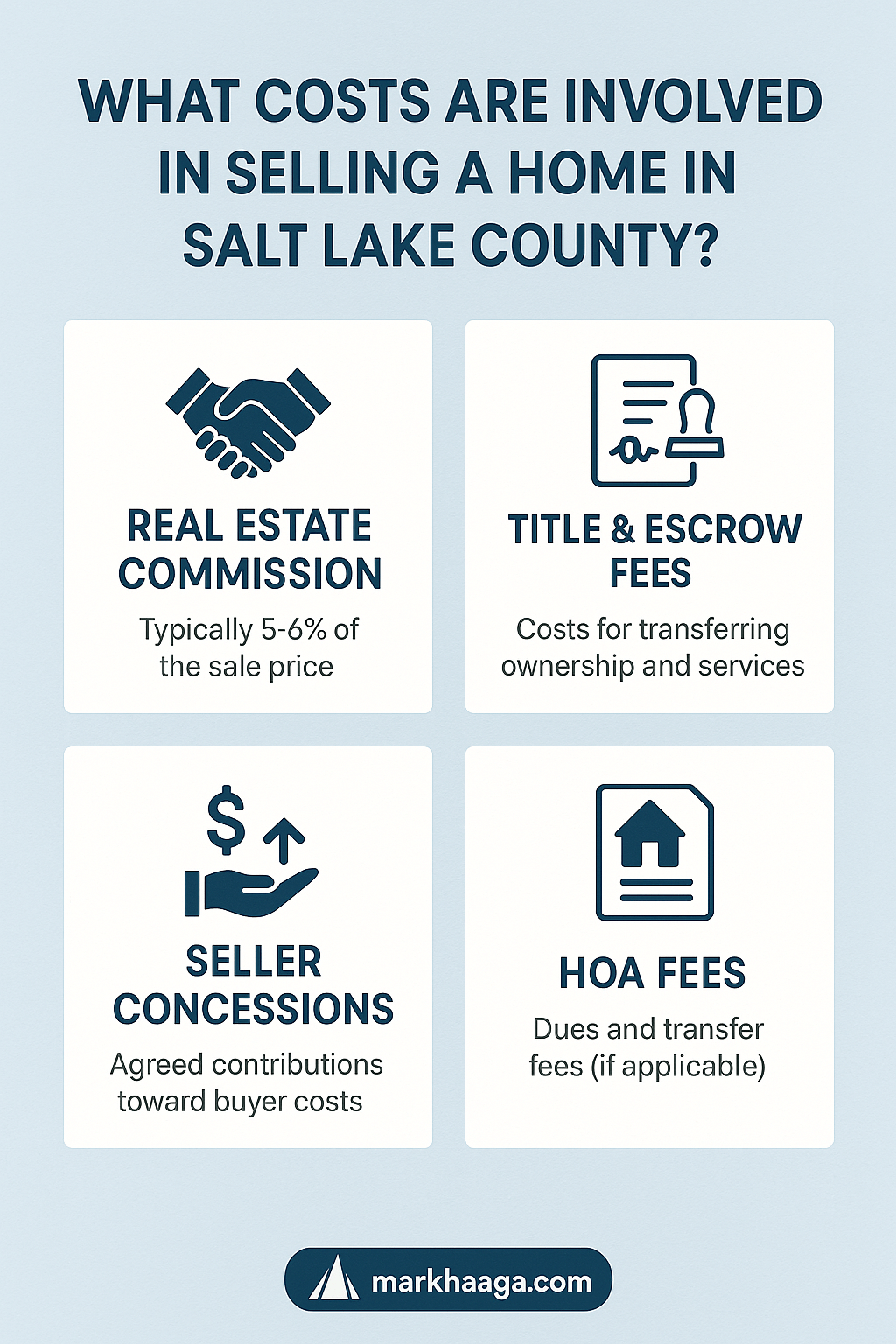

A quick visual summary of key expenses sellers should plan for in the Salt Lake County real estate market

3. Seller Concessions (if negotiated)

Typical Range: Up to 3% of the sale price, depending on market conditions and buyer loan type

Seller concessions are negotiated costs that you, the seller, may agree to pay to help cover the buyer’s closing expenses. These can include loan origination fees, title fees, prepaid taxes, or even home warranty costs. Concessions are common when buyers are using government-backed loans (FHA, VA, USDA) or when market competition is low.

While 3% is a typical cap on concessions, the actual amount can vary—and giving too much away can cut into your bottom line. That’s why having a sharp negotiator on your side matters.

💬 Mark Haaga is a skilled contract negotiator with experience structuring win-win deals. Our team helps you identify when concessions are necessary—and when to push back—to protect your net proceeds.

We don’t just accept every request. We break down the real impact of concessions and work with buyers' agents to find alternatives that protect your pricing power while still closing the deal.

📌 Our goal is to put more money in your pocket—not just close the sale.

📌 Mark Haaga’s team helps you respond strategically to concession requests to protect your net proceeds.

4. Repairs or Improvements

Typical Cost: $0–$5,000+ depending on condition

Pre-sale repairs, staging, or cleaning may help your home sell faster or for more—but they’re optional. Some sellers also agree to repair items flagged during the buyer’s inspection.

🛠 We’ll walk you through which repairs are worth doing—and which ones you can skip.

5. Mortgage Payoff + Prepayment Penalties (if applicable)

You’ll need to pay off your existing mortgage at closing. Some loans have prepayment penalties, so check your payoff statement for any extra charges.

💬 We help you calculate your net proceeds by reviewing your mortgage payoff early in the process.

6. HOA Transfer or Disclosure Fees (if applicable)

Typical Cost: $300–$2,000+ depending on community and policies

If your property is part of a Homeowners Association (HOA), you may be required to pay fees to transfer ownership, provide disclosures, or cover enhancement charges. These fees are often due at closing and vary widely by community.

For example, Daybreak—a large and popular master-planned community in South Jordan—charges a 0.5% Community Enhancement Fee on the sale price of your home. This fee is paid by the seller (or can be negotiated in the offer) and goes toward reinvestment in shared community spaces and amenities.

📌 For Daybreak HOA info and the latest fee disclosures, visit the official site: Daybreak Realtor & Seller Resources

Common HOA-related seller costs include:

Transfer or reinvestment fees

Document preparation charges

Status letter or resale certificate fees

📄 We communicate directly with your HOA early in the process so there are no last-minute surprises.

7. Home Warranty (Optional)

Typical Cost: $600–$800+ (if offered)

Some sellers offer a one-year home warranty to attract buyers or prevent disputes over minor post-sale issues. This is optional. One example is IBEX Home Warranty, which serves Utah's Wasatch Front with comprehensive plans and options for sellers and buyers. You can view their coverage and pricing sheet here: IBEX Home Warranty Plan – Wasatch Front.

🛡 We’ll help you decide if offering a warranty makes sense in your situation.

8. Capital Gains Taxes (Consult Your CPA)

If you’ve lived in the home for less than two of the last five years—or are selling an investment property—you may owe capital gains tax. The IRS requires that to qualify for the capital gains exclusion (up to $250,000 for individuals or $500,000 for married couples), you must have lived in the home as your primary residence for a total of 24 months within the last five years before the sale. You can learn more directly from the IRS guidance on home sale exclusion.

Always consult a tax professional to verify your specific situation.

📢 Mark Haaga’s team doesn’t give tax advice—but we flag scenarios where a CPA should be brought in.

Final Thoughts: Know Before You List

Find out what your home is worth before factoring in your selling costs. Use our free valuation tool to get started.

Selling your home in Salt Lake County involves several costs—but planning ahead helps you keep more of your bottom line.

The Mark Haaga Real Estate Team breaks down every fee and helps you compare offers based on net proceeds—not just price.

Thinking of selling? Let’s talk about what your home is worth and how to keep more of it.